The 5-Second Trick For Tulsa Bankruptcy Filing Assistance

The 5-Second Trick For Tulsa Bankruptcy Filing Assistance

Blog Article

Some Known Facts About Tulsa Bankruptcy Consultation.

Table of ContentsSee This Report about Experienced Bankruptcy Lawyer TulsaWhat Does Affordable Bankruptcy Lawyer Tulsa Do?How Chapter 13 Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.Not known Details About Top Tulsa Bankruptcy Lawyers Some Known Incorrect Statements About Chapter 7 Bankruptcy Attorney Tulsa

The stats for the other primary type, Phase 13, are even worse for pro se filers. (We break down the differences between both enters deepness listed below.) Suffice it to claim, speak to an attorney or 2 near you that's experienced with personal bankruptcy legislation. Right here are a couple of sources to locate them: It's easy to understand that you may be reluctant to spend for an attorney when you're currently under substantial economic pressure.Many attorneys additionally use cost-free examinations or email Q&A s. Make use of that. (The non-profit app Upsolve can assist you discover complimentary appointments, resources and legal help at no cost.) Inquire if bankruptcy is indeed the appropriate option for your scenario and whether they believe you'll qualify. Before you pay to submit insolvency types and imperfection your credit scores report for up to one decade, inspect to see if you have any sensible choices like financial debt negotiation or non-profit credit rating counseling.

Advertisement Now that you have actually chosen insolvency is without a doubt the appropriate training course of activity and you hopefully removed it with a lawyer you'll require to get begun on the documents. Before you dive right into all the main personal bankruptcy kinds, you ought to obtain your own papers in order.

Top Guidelines Of Tulsa Bankruptcy Filing Assistance

Later down the line, you'll really require to prove that by disclosing all types of info regarding your financial affairs. Right here's a fundamental listing of what you'll require when traveling in advance: Determining papers like your vehicle driver's permit and Social Security card Income tax return (as much as the past four years) Proof of earnings (pay stubs, W-2s, freelance revenues, earnings from assets as well as any income from government benefits) Financial institution declarations and/or pension declarations Evidence of worth of your properties, such as car and property valuation.

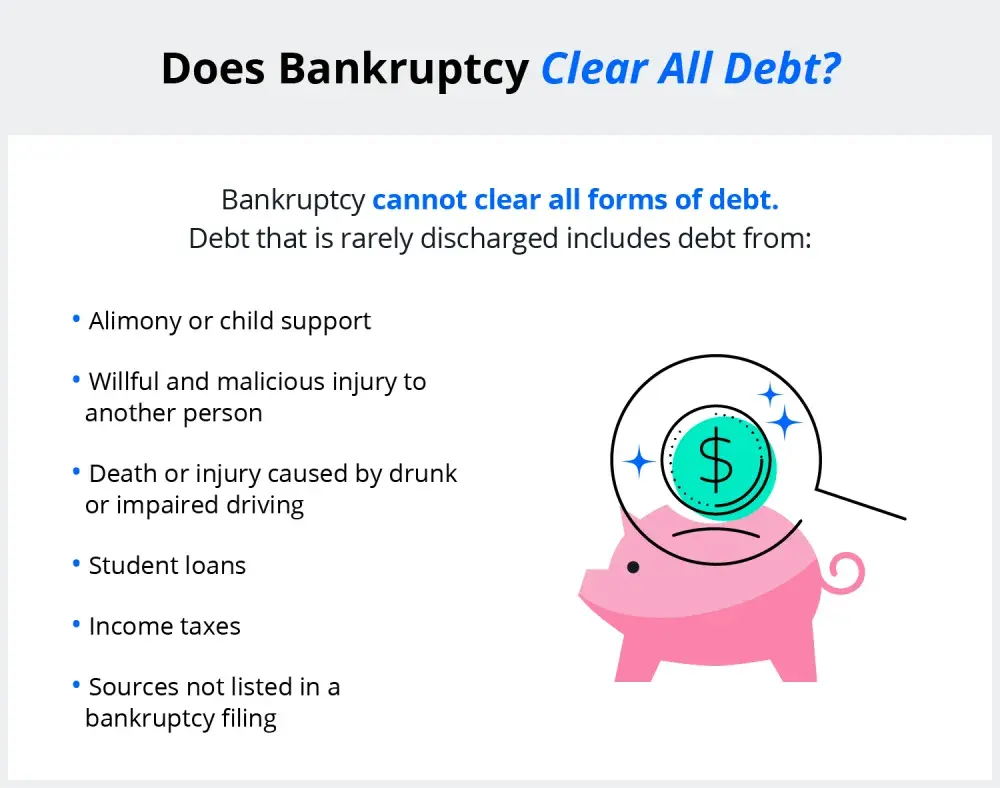

You'll intend to comprehend what kind of financial obligation you're trying to fix. Financial debts like kid support, alimony and certain tax obligation financial obligations can't be released (and personal bankruptcy can't stop wage garnishment pertaining to those financial obligations). Student loan financial obligation, on the other hand, is possible to release, however keep in mind that it is hard to do so (Tulsa bankruptcy attorney).

You'll intend to comprehend what kind of financial obligation you're trying to fix. Financial debts like kid support, alimony and certain tax obligation financial obligations can't be released (and personal bankruptcy can't stop wage garnishment pertaining to those financial obligations). Student loan financial obligation, on the other hand, is possible to release, however keep in mind that it is hard to do so (Tulsa bankruptcy attorney).If your income is as well high, you have an additional alternative: Chapter 13. This alternative takes longer to solve your financial debts since it needs a long-lasting settlement strategy usually three to five years prior to a few of your staying financial debts are cleaned away. The declaring process is additionally a whole lot much more complex than Phase 7.

Some Known Details About Tulsa Bankruptcy Filing Assistance

A Phase 7 personal bankruptcy remains on your credit record for 10 years, whereas a Phase 13 personal bankruptcy falls off after seven. Prior to you send your additional info insolvency kinds, you have to initially finish a required program from a credit scores counseling firm that has been accepted by the Division of Justice (with the notable exception of filers in Alabama or North Carolina).

The training course can be completed online, personally or over the phone. Training courses normally cost in between $15 and $50. You must finish the course within 180 days of declaring for insolvency (Tulsa OK bankruptcy attorney). Make use of the Division of Justice's website to discover a program. If you stay in Alabama or North Carolina, you have to choose and finish a program from a checklist of separately authorized suppliers in your state.

Our Chapter 7 Vs Chapter 13 Bankruptcy Diaries

Examine that you're submitting with the appropriate one based on where you live. If your irreversible residence has relocated within 180 days website link of filling, you must submit in the district where you lived the higher portion of that 180-day duration.

Typically, your personal bankruptcy lawyer will function with the trustee, however you may require to send the individual files such as pay stubs, income tax return, and checking account and credit scores card declarations directly. The trustee who was simply appointed to your case will certainly quickly establish a mandatory conference with you, called the "341 meeting" due to the fact that it's a demand of Area 341 of the united state

You will certainly need to offer a timely checklist of what qualifies as an exception. Exemptions might put on non-luxury, primary automobiles; essential home products; and home equity (though these exceptions regulations can differ extensively by state). Any kind of building outside the listing of exemptions is thought about nonexempt, and if you don't offer any type of checklist, after that all your home is thought about nonexempt, i.e.

You will certainly need to offer a timely checklist of what qualifies as an exception. Exemptions might put on non-luxury, primary automobiles; essential home products; and home equity (though these exceptions regulations can differ extensively by state). Any kind of building outside the listing of exemptions is thought about nonexempt, and if you don't offer any type of checklist, after that all your home is thought about nonexempt, i.e.The trustee wouldn't sell your cars to instantly repay the lender. Instead, you would certainly pay your lenders that quantity throughout your settlement strategy. A common false impression with personal bankruptcy is that when you submit, you can stop paying your debts. While bankruptcy can assist you erase a number of your unsecured financial debts, such as past due clinical expenses or individual lendings, you'll desire to maintain paying your regular monthly settlements for secured financial obligations if you wish to maintain the residential property.

The Best Strategy To Use For Affordable Bankruptcy Lawyer Tulsa

If you're at danger of foreclosure and have actually exhausted all various other financial-relief alternatives, then declaring Phase 13 might delay the foreclosure and conserve your home. Ultimately, you will certainly still require the earnings to continue making future home mortgage repayments, as well as paying off any kind of late settlements over the training course of your settlement plan.

If so, you might be required to supply added details. The audit could postpone any financial debt alleviation by numerous weeks. Certainly, if the audit turns up incorrect details, your case could be disregarded. All that said, these are rather uncommon circumstances. That you made it this far while doing so is a respectable indication a minimum of several of your debts are eligible for discharge.

Report this page